Maria 01, Building 5, entrance B

Lapinlahdenkatu 16, 00180 Helsinki

Making history? lets@maki.vc

Press inquiries: press@maki.vc

Blog | Nov 1, 2019

WRITTEN BY Paavo Räisänen

WRITTEN BY Paavo Räisänen

Maki.vc joined forces with Combient Foundry to put together a survey on collaboration between industrial deep tech startups and corporations. One of the main findings we learned from approximately 100 Nordic founders and corporate executives was that far too few collaborations have led to commercial deployments. Luckily though, many startup-corporate collaborations included a pilot that acts as the crucial push for industrial deep tech startups to cross the death valley.

As pilots can be tricky, yet potential change-makers for startups in a path to commercial deployment, I decided to dive a bit deeper into the topic. I’ll share insights gained from collaborations I’ve been a part of. Currently, I’m involved with two manufacturing tech companies (Altum & ColloidTek) as well as one material technology company (Spinnova). Before joining Maki.vc, I gathered experience both from the startup and corporate side. In this first part, I’ll focus on the transition from technology development to piloting, and later, I’ll publish a piece about displacing the pilots with commercial deployments.

Industrial deep tech startups typically have a novel technical solution that can be applied to multiple industries and have various applications. What’s common for the path of deep tech startups is that they must prove their solution and ability to deliver to their bigger counterparties before reaching any larger commercial agreements. Pilots are an essential way to reach this, and a great technology and product does not guarantee success. Next, I’ll share some best practices on how to put the pilot on track before deployment.

Don’t wait too long. Selling cycles for corporates can be lengthy so better start negotiating about pilots as soon as possible. This way you ensure a faster learning cycle to understand what your customers really need, and can develop your offering based on these insights. Moreover, by starting early, you’re able to validate more business cases, and thus become more equipped to decide which industries and applications to prioritize. Without early customer contact, there’s a high risk of doing useless R&D work.

Starting sales activities early enough can be painful, especially for research-originated or engineer-driven teams that are used to reach perfection before publishing any results of their work for external evaluation.

Matti Järveläinen, CEO of ColloidTek, emphasizes that sometimes you just need a little external push: “Luckily our first angel investors pushed us to get involved with the customers when we thought we weren’t ready. This was a big mindset change for an entire team of ex-researchers and made the whole company culture more customer-centric from the beginning.”

All industries have early adopters that others follow in terms of technologies used. They are the thought leaders through whom you can reach the masses, and thus the ones you should actively approach. Thought-leaders are not necessarily always the biggest corporations in their industry — sometimes smaller companies have reached a position where large corporations are following them in technology adoption.

Spinnova’s CMO Emmi Berlin highlights the importance of finding the early adopter brands that are brave enough to start a public collaboration: “Most prefer to wait for the commercial phase. I think this is partly because the textile industry lacks an innovation and co-creation culture which is more typical for the software industry. Launching something already on a concept level is still rare, but becoming more common.”

Moreover, it’s important to identify the right contact person within the corporation. Ideally, the main contact person should be simultaneously open-minded for innovations and have the decision-making power to push the project forward. Otherwise the startup can end up spending an enormous amount of time in different meetings without reaching any conclusion.

Matias Tainela, CEO of Altum has learned to prioritize the cases in hand: “We have learned to say no to customers if things are not moving forward fast enough or if there is not a good enough match. As we have limited resources to push all opportunities forward, we need to prioritize the ones which have the right-minded people around the table.”

When negotiating the start of a pilot, there are often many opportunities and business cases for a company on the table. You should try to navigate and focus on the big ones. Thus, it’s good to understand early on that customers aren’t always used to calculating the benefits of a certain business case. This means that you probably need to support and educate the customer — help them find all the benefits of each business case so you’re able to choose the most potential one to focus on together.

As an example, ColloidTek had an industrial customer whose research team originally identified 20 potential applications. The probability to succeed in a pilot increased significantly when all possible option were pre-screened and instead of starting to build a pilot without first delving into business case calculations.

During the screening, it’s important to identify if the idea is a “one-of-a-kind” or “first-of-a-kind” solution. The latter meaning that the same problem appears in different factories of the same company and preferably also in different companies within the same industry. Startups should always look for solutions that have an opportunity for repeat sales and avoid doing one-of-a-kind solutions.

By creating productized, simple packages, you lower the barrier to start the pilot and gain your first references. Note that many corporate cultures are relatively risk-averse (at least compared to startups) and therefore, the decision-maker usually takes a personal risk when recommending a new technology. A typical way to mitigate this is to sell a small validation package first.

Both Altum and Collo use this approach especially when using the product in new applications or industries. For example, Collo’s liquid analytics is bringing online measurements to industries that have typically relied on lab measurements. In these cases, it’s natural to sell a validation project where liquids from the customer’s process are measured both by Collo’s sensor and in the lab to validate the case.

Free trials and low pricing should still be avoided as paid trials are a great way to test the commitment of the partner. A price tag of 10–50k for the first validation project shouldn’t be a problem for corporates if they are serious with your technology and the upside (business case) is lucrative enough.

You have agreed on your first pilot project? Now, to guarantee a pilot is worth both of your resources, it’s important that you and your customer’s team fully commit to see the project through. Positive results and first references aren’t only crucial for the continuum of the collaboration, but also for attracting new partners, investors and customers.

To reach a successful pilot, you need to have a mutual understanding on the definition of a successful pilot. Although you’ve agreed on high-level targets during the sales phase, make sure to revisit them at the beginning of the project to ensure all stakeholders are aligned — not just the decision-makers. And, don’t leave it there, agree on what it means in terms of next steps if the pilot is successful. This way you build a great foundation for the follow-up discussion regarding the collaboration.

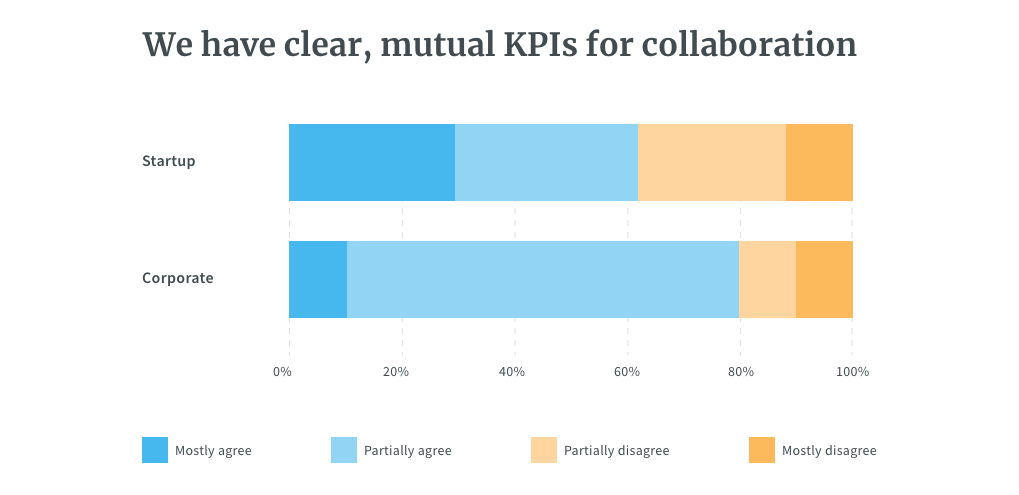

When you’ve arrived at an agreement, set quantitative KPIs and measure them systematically. Based on our survey, this luckily seems to be the case in many partnerships, although there’s still room for improvement.

Results from a survey on collaboration between industrial deep tech startups and corporations.

In the worst case, we’ve seen customers changing the agreed targets in the middle of the project, and projects with moving targets aren’t really projects at all. Therefore, I recommend dedicating time to define success factors in the beginning — this pays off later.

Project management will probably be one of the pain points for the first pilots. There’s always the challenge of not knowing the unknowns. However, when you take notes and learn from each project, you will just keep getting better and better at it. But here’s some tips that might make your learning path a bit easier.

First, you need a cross-functional team, including members from both companies to carry out a successful pilot. With this team, start by agreeing on the fundamentals so you don’t drop the ball in the middle of the project. This includes making sure that timeline, and dedicated roles and responsibilities are agreed by both parties.

Second, make sure the internal communication between the task force flows throughout the project. This is often achieved best by many-to-many communication. This means that you find and connect counterparties for different roles in both organizations to build trust and boost change management.

And lastly, try to identify risks early on and bring up solutions already during the project. Unfortunately, too often customers bring up the problems only when it’s too late to react.

Pilot projects between startups and corporations are engaged by both parties to learn as much as possible — and with hope to find a beneficial business case. To maximize your learnings, systematically collect both quantitative and qualitative data to understand what works and what doesn’t. And note that qualitative data can and should be collected also in informal discussions whenever possible. You can never be too curious about the business, technologies and processes of your customer.

As an example, you should understand which old solution (or way of working) is your solution going to replace and what have been the strongholds and disadvantages of the old solution. If switching to your solution causes issues to anyone within the organization, you will face change resistance sooner or later.

When you have enough data points, bring it all back to high-level to understand what it really means: is this industry and application one we should prioritize or not? Is there a business case for both parties? What is the best way to move forward?

Some pilots will not (and should not) lead to commercial deployments — that’s a fact — but you just need to make sure that both parties have the necessary tools to form a fact-based decision.

I hope you found this piece insightful and gained some practical takeaways. I’m always happy to engage in discussion around the world of industrial solutions, so feel free to reach out. In the next part, I’ll focus on how to move from pilots to commercial deployments.

Author: Paavo Räisänen is an early-stage VC investor at Maki.vc. Focusing on B2B SaaS and Industrial Solutions. paavo@maki.vc @PaavoRaisanen