Maria 01, Building 5, entrance B

Lapinlahdenkatu 16, 00180 Helsinki

Making history? lets@maki.vc

Press inquiries: press@maki.vc

Blog | Oct 11, 2020

Marjo has been part of leadership at Ensto (a global family business in smart electrical solutions that employs around 1,400 people in Europe, the US and Asia) since 1988 and chairwoman from 2016 onwards. She’s also Chair of the Board of the Technology Industries in Finland and TT Foundation, board member in the Confederation of Finnish Industries, and sits on the boards of Technology Academy Finland TAF, EVA, ETLA and state-owned Solidium Oy. She is also partner at Boardman Oy – so let’s just say she has seen enough that she could write a full book series on leadership and board work.

While we’re waiting for her publishing deal, we’ve decided to share her top five tips for entrepreneurs forming or starting to work with their first boards:

“Even though numbers represent history, they’re the most important asset you and your board have in your arsenal. They’re indisputable, objective snapshots of how your strategy has worked in practice. That’s why numbers are the key piece of information needed to answer the question: how is this company doing? – so make sure your board receives up-to-date numbers at regular and short enough intervals. At Ensto, we send an info package to the board on the 10th of each month as opposed to waiting for the next board meeting. Management and the board get the information at the same time, and both are equally well prepared for the next meeting.”

“This is something that can’t be stressed enough, especially for early stage startups. Some companies forget about cashflow even though it’s one of the most important indicators of company health. Cashflow is where we start every board meeting: do we have enough runway and if so, for how long? Too many companies focus on combing through their income statements and balance sheets, and end up ignoring their real cash flow position. It’s important to always know your runway and breakeven points. In the worst-case scenario, your outlook for the year might look profitable in March, but you could end up running out of cash before the summer is over. Covid-19 has served as an unfriendly reminder for many startups about the importance of maintaining cashflow and a view of the company’s runway.”

“Entrepreneurs building their board should always start with themselves. What are my strengths and skills? Where are my weaknesses? Start mapping the types of profiles you need around you to build on your strong points and consolidate your weaknesses, and keep in mind that you’ll need different profiles throughout the company’s lifespan. When first forming your board, you might need more hands-on support on daily operations, whereas in times of growth, you most likely need an international network and experience from scaling. This is also the time to broaden your network and structure the board work. And although we’re focusing on boards here, remember that you’re not limited to finding support on your board — mentors can also form valuable support networks for founders. Throughout my career, I’ve always had 2–3 people to brainstorm with in addition to board members.”

“Meet with your board candidates and really get to know them well. It’s important you strike a chord with the person, because you’ll likely be working with them for at least three years, so you’ll need to commit to them and vice versa. But don’t get stuck in a bad relationship: identify when someone is not the right fit early on. Warning signs I’ve run into over the years are board members who come into a meeting ill-prepared and unwilling to join the discussion. On the other hand, board members who dominate the discussion and don’t give space to others can also be harmful to the board dynamics.”

“No matter what anyone else tells you, the most important part of board work is the relationship between the CEO and Chairperson. It’s a two-way relationship where both need to be active in sharing and asking for information. When this relationship doesn’t seem to be working, it’s often customary that the CEO is subbed out — during my career, I’d say that 8/10 times it’s the CEO who goes. But this can be rash: if the relationship between a CEO and Chairperson is faltering, the role and behaviour of both parties needs to be assessed. Naturally, in cases like these, the company’s best interest should always be priority.”

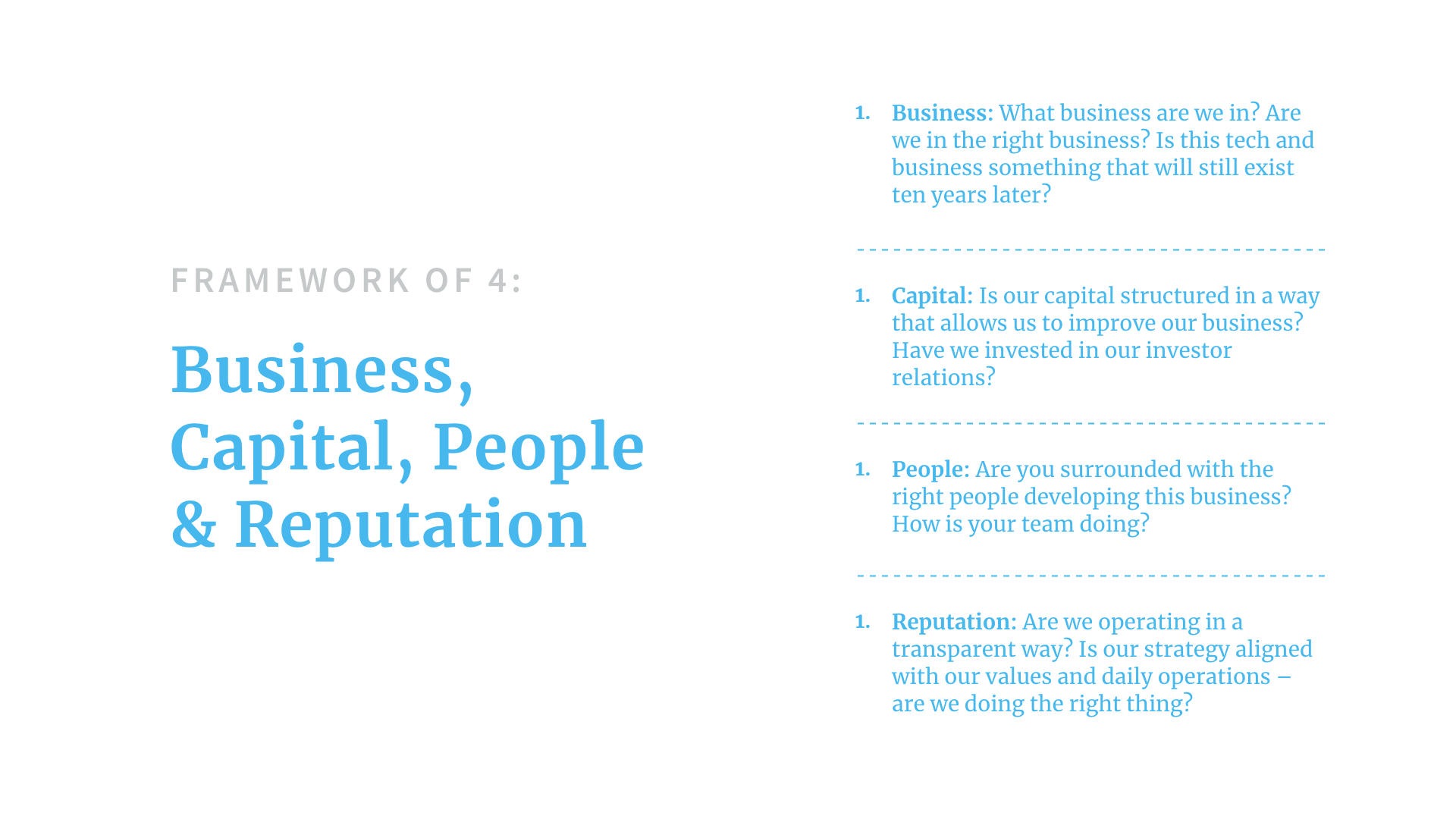

As a final takeaway, grab Marjo Miettinen’s framework for strategy — the four pillars she returns to as an entrepreneur or board member. She believes these pillars are important for any owner or entrepreneur to constantly keep in mind and keep their focus:

Marjo Miettinen is a seasoned tech executive and business owner with a strong record of board work. She currently chairs the boards of the Technology Industries in Finland, TT Foundation and Ensto, where she was previously part of the leadership team. Marjo has also co-founded Women in Tech, a network that aims to promote diversity, inclusion and equity in technology.